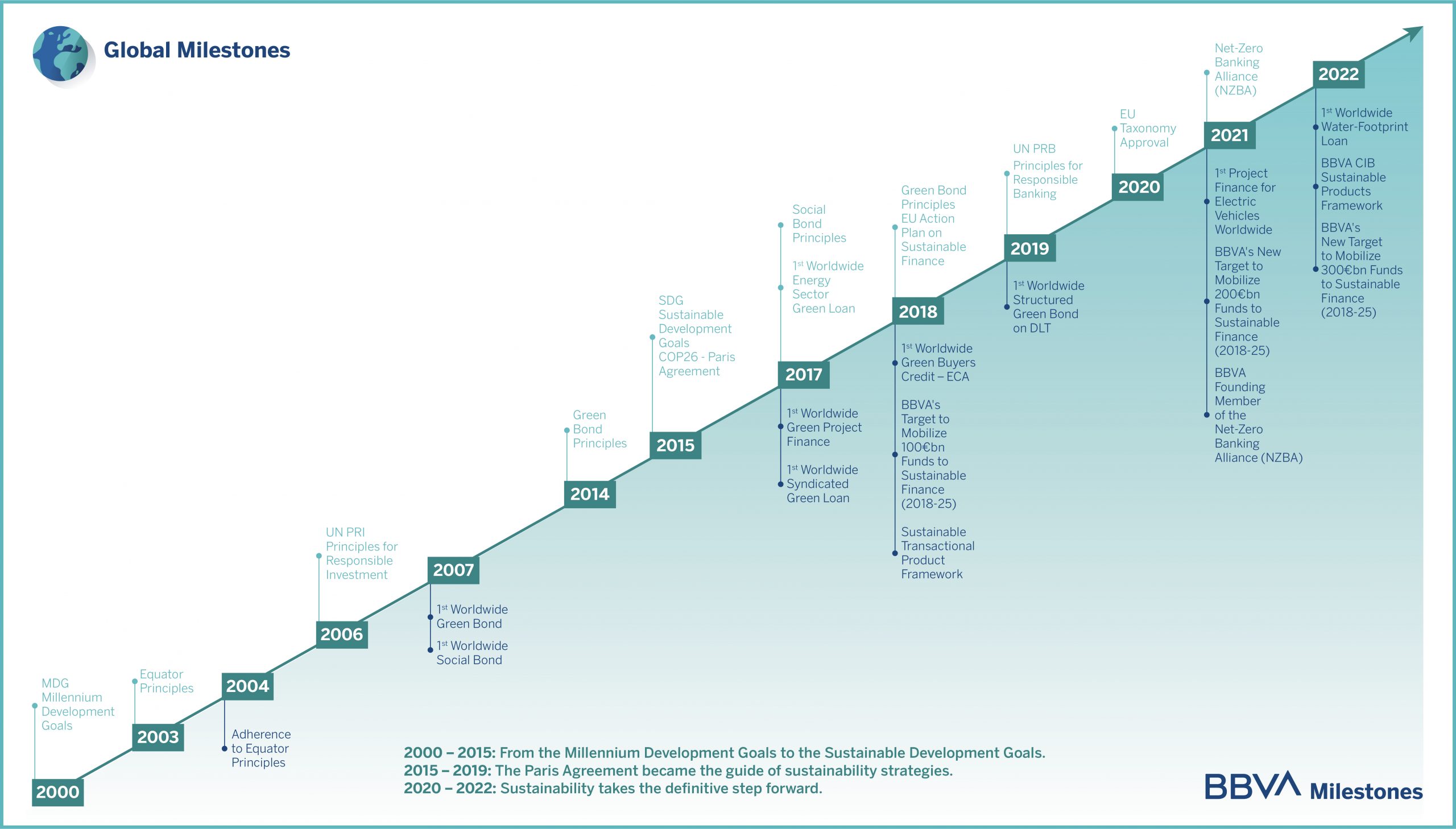

Awareness and concern for the future of the planet began in the 1990s and reached its peak in 1997 with the approval of the Kyoto Protocol. Since then, the efforts of organizations, governments and large companies have been increasing. Below we review the most relevant achievements in the sustainability arena at BBVA and around the world.

2000 – 2015:

From the Millennium Development Goals to the Sustainable Development Goals.

The Millennium Development Goals were established in 2000, a global initiative aimed ataddressing poverty, environmental degradation and discrimination against women, among others.In 2015, these goals were renewed and called the Sustainable Development Goals (SDGs), aimedat creating global goals related to the environmental, political and economic challenges our worldis facing.

In this context, BBVA became the first Spanish financial institution to sign the Equator Principles in 2004. The Principles, introduced by the World Bank and the International Finance Corporation in 2003, and adopted at the time of signing by 23 major entities around the world, is one of the most important international initiatives for assessing the social and environmental risks of projects they finance in developing countries.

Three years later, in 2007, the head of the bond business at BBVA became aware of new bonds issued which were different from the others, and decided that BBVA had to be part of this. The European Investment Bank (EIB) has just completed an issue in which the capital had to be allocated to sustainable projects and to which it has given the commercial name of “green bond.” This was the first green bond in history and the one that gave its name to this new pioneering product in the market. It was not until 2014 that the Green Bond Principles were created, the voluntary guide of procedures that recommend transparency and disclosure of information, which also promotes integrity in the development of the green bond market.

2015 – 2019:

The Paris Agreement became the guide of sustainability strategies.

2015 was an important year because the new Sustainable Development Goals were redefined, as well as 2016, the year in which the historic Paris Agreement was signed by representatives of nearly 200 countries at the Climate Summit, adopted to tackle global warming caused by greenhouse gas emissions. This was the sign that many had been waiting for, including investors, since the leaders of the vast majority of countries in the world began discussing climate change more than two decades ago.

At the time, green bonds were a consolidated product and were reaching relevant issuance volumes (41,300 million dollars in 2015). Moreover, we started to hear about another similar product geared toward making a social impact. The Social Bond Principles were published in 2017. In 2018, the European Commission published its Action Plan to boost the contribution of the financial industry to achieving a more sustainable global economy.

Between 2017 and 2019, BBVA completed the most pioneering transactions on the global scale: the first green loan of an energy company; the first green syndicated loan; or the first green “project finance” transaction; or the first structured green bond with “blockchain” technology, among others. In addition, in 2018, it created a pioneering sustainable transactional banking framework in the industry, which allowed companies to categorize their short and medium-term financing instruments as green, social or sustainable.

BBVA’s commitment to sustainability was materialized in 2018 with the announcement of its strategy to fight climate change and promote sustainable development, currently one of the most ambitious among large financial institutions. The bank set a target of mobilizing 100,000 million euros in green financing, sustainable infrastructure, social entrepreneurship and financial inclusion by 2025. In addition, it announced its commitment to help mitigate environmental and social risks and thus minimize potentially negative direct and indirect impacts, as well as to raise the awareness on the need for a greater contribution of the financial sector to sustainable development.

2020 – 2022:

Sustainability takes the definitive step forward.

In this period, there are two very relevant milestones that drive sustainable efforts on a global scale. First, the European Union’s taxonomy of sustainable finance was approved in 2020, which serves as an instrument to help financial agents and companies define which activities are considered as such. The net zero banking emissions alliance agreement was also signed, which was joined by BBVA with another 43 founding members. The banks in this international alliance are committed to making all loan and investment portfolios neutral in net greenhouse gas emissions by 2050.

In 2021, given the good level of achievement of the sustainable financing goal, BBVA decides to double it to 200,000 million euros. As of June 30, 2022, it had already mobilized 112,000 million, a pace that leads to raising the goal again, in October 2022, up to 300,000 million, thus multiplying the initial commitment for the 2018-2025 period by three.

In addition, BBVA continues to be a pioneer in terms of sustainable products. In 2021, the bank acted as the “Mandated Lead Arranger” (MLA) in the first electric vehicle “project finance” transaction in the world. In 2022, it created a new product that focuses on reducing the water footprint of companies, the “water footprint” loan.

In addition to being a global obligation from the point of view of responsible business activity, sustainability is a clear business opportunity. And “BBVA is here to accompany all companies that wish to move toward the energy transition of their business models with a strong start”, stated Luisa Gómez Bravo, Global Head of BBVA Corporate & Investment Banking at the II BBVA Sustainability Forum held in September.