News | 27 January 2026

Bridging Trade and Sustainability: How Export and Agency Finance Is Powering Asia’s Transition

Sarah Yu, Head of Export and Agency Finance Asia, BBVA

Trade finance is no longer just a financing tool, it’s a catalyst for sustainable development.

With rising climate ambition, shifting policy frameworks, and growing demand for long-tenor capital, ECAs are becoming vital partners in bridging capital flows, accelerating green projects, and enhancing resilience across the region.

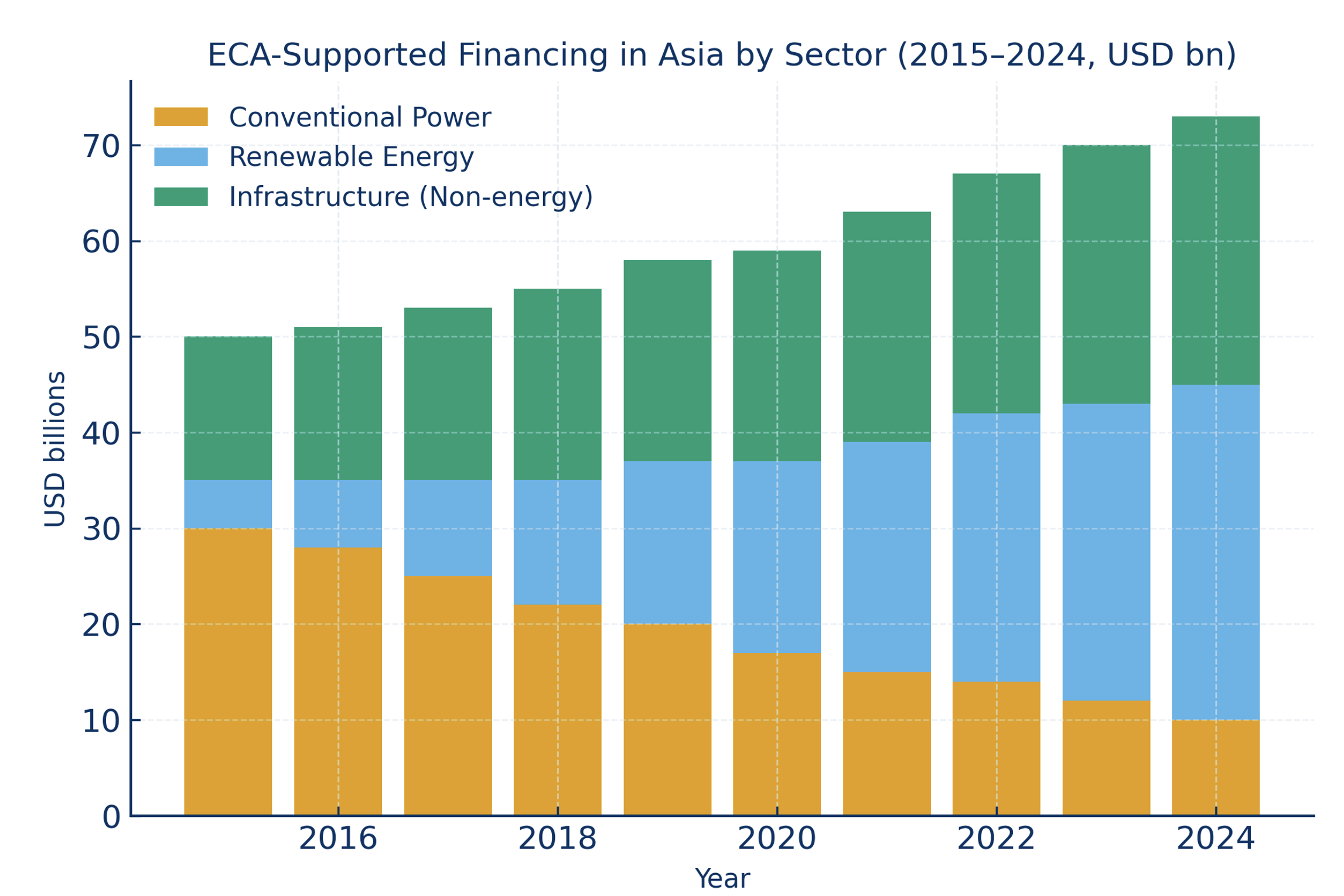

As Asia’s economies accelerate their decarbonization and regional connectivity ambitions, the role of Structured Trade Finance—specifically Export and Agency Finance (EAF)—has evolved far beyond a simple risk mitigation tool. Once primarily used to support exporters with long-tenor financing, EAF is now a strategic enabler of sustainable investment and energy transition across Asia and beyond.

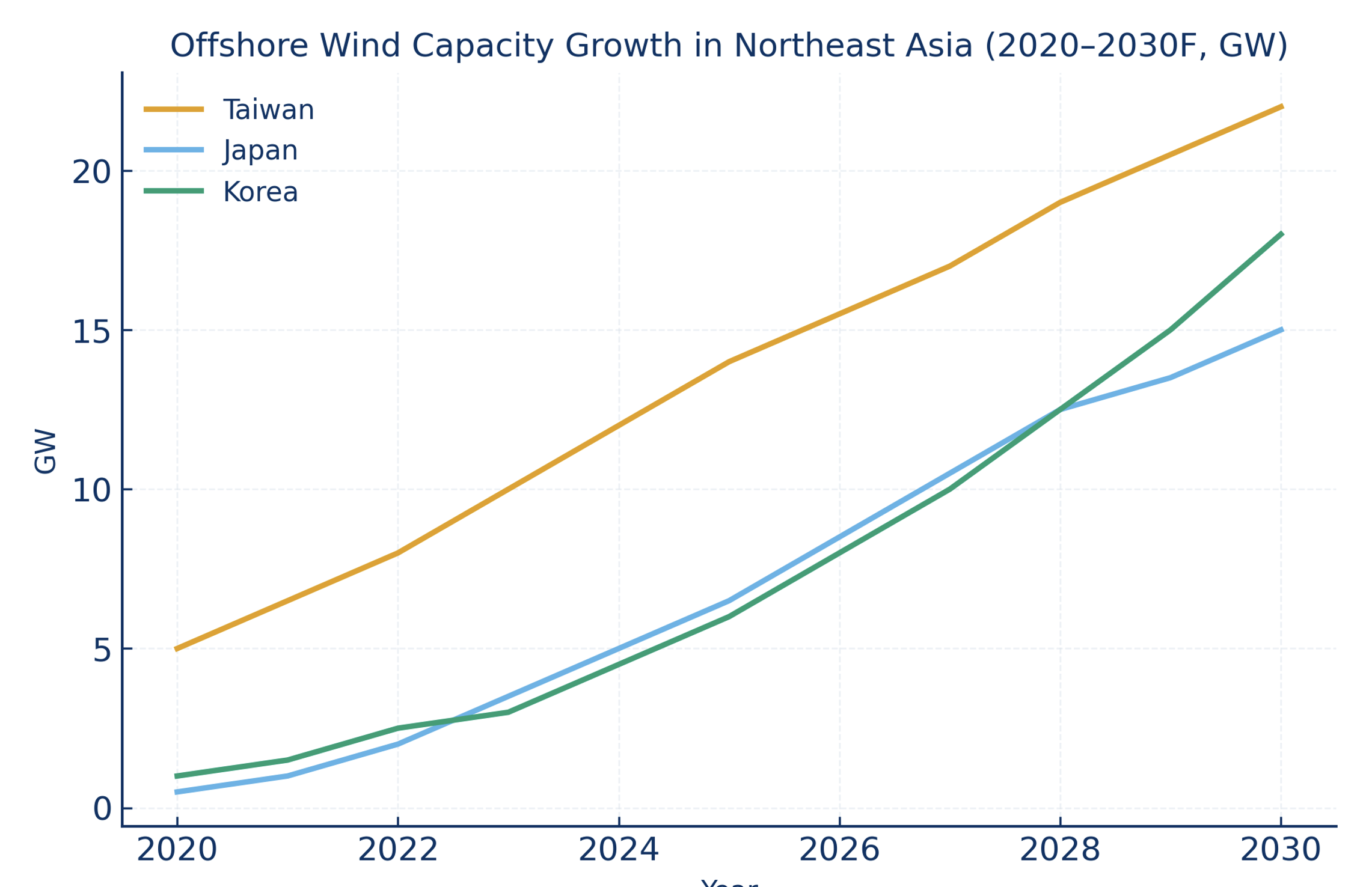

Today, Asian export credit agencies (ECAs) such as KEXIM, KSURE, JBIC, NEXI, and Sinosure are not only protecting national exporters—they are mobilizing capital for renewable projects, advancing the global sustainability agenda, and connecting Asia’s industrial capacity to green opportunities across the world.

Asia’s Outbound Trade Meets the Global Green Agenda

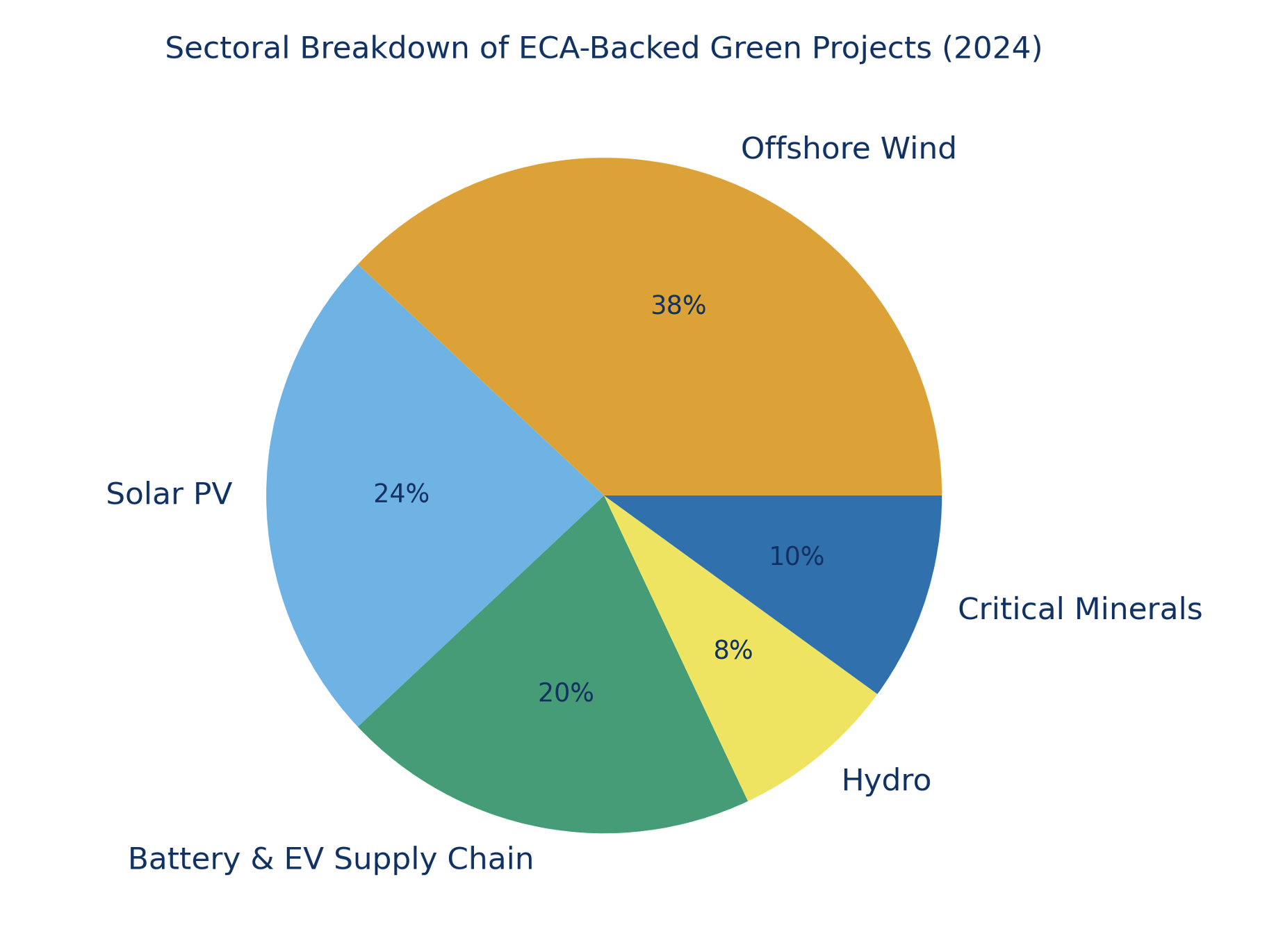

The intersection of outbound Asian trade and sustainability is rich with opportunity. Chinese solar manufacturers are supplying equipment to Middle Eastern markets aiming to maximize photovoltaic (PV) potential; Japanese investors are backing hydropower projects in Indonesia; and Korean and European ECAs are supporting East Asia’s offshore wind development.

These cross-border flows illustrate a powerful dynamic: Asia is no longer just the world’s factory—it is becoming a critical driver of the global energy transition. ECA-backed financing allows complex projects to take shape even in uncertain environments, providing long-term liquidity, credit enhancement, and cross-border collaboration.

Southeast Asia’s Growth Dilemma: Balancing Power and Progress

Nowhere is the tension between economic growth and sustainability more visible than in Southeast Asia. The region has long been identified as the next growth engine of renewable energy, but governments face a delicate balancing act: securing low-cost, reliable power while honoring commitments to net-zero targets.

As a result, many Southeast Asian economies are pursuing an intermediate transition from coal to gas before reaching large-scale renewable deployment. This pragmatic path recognizes that energy security remains paramount, but it also highlights why ECA involvement is indispensable. By providing long-term, low-cost funding and risk cover, ECAs can make renewable projects bankable even in emerging markets with evolving policy regimes.

Strategic Opportunities: From Singapore to Australia

In this context, several landmark opportunities are emerging across the region—from Singapore’s renewable import tender to Australia’s rare earth development and Indonesia’s nickel-based battery supply chain. These developments demonstrate the convergence of trade, technology, and sustainability, with ECAs acting as catalysts for both capital mobilization and responsible investment.

India’s Ambition and the Role of ECAs

India stands at a pivotal moment. Its ambition to boost manufacturing and infrastructure is clear, but structural bottlenecks could slow progress. The next frontier lies in broadening ECA access to mid-tier corporates and infrastructure sponsors, where long-tenor funding can unlock greenfield projects and supply chain resilience.

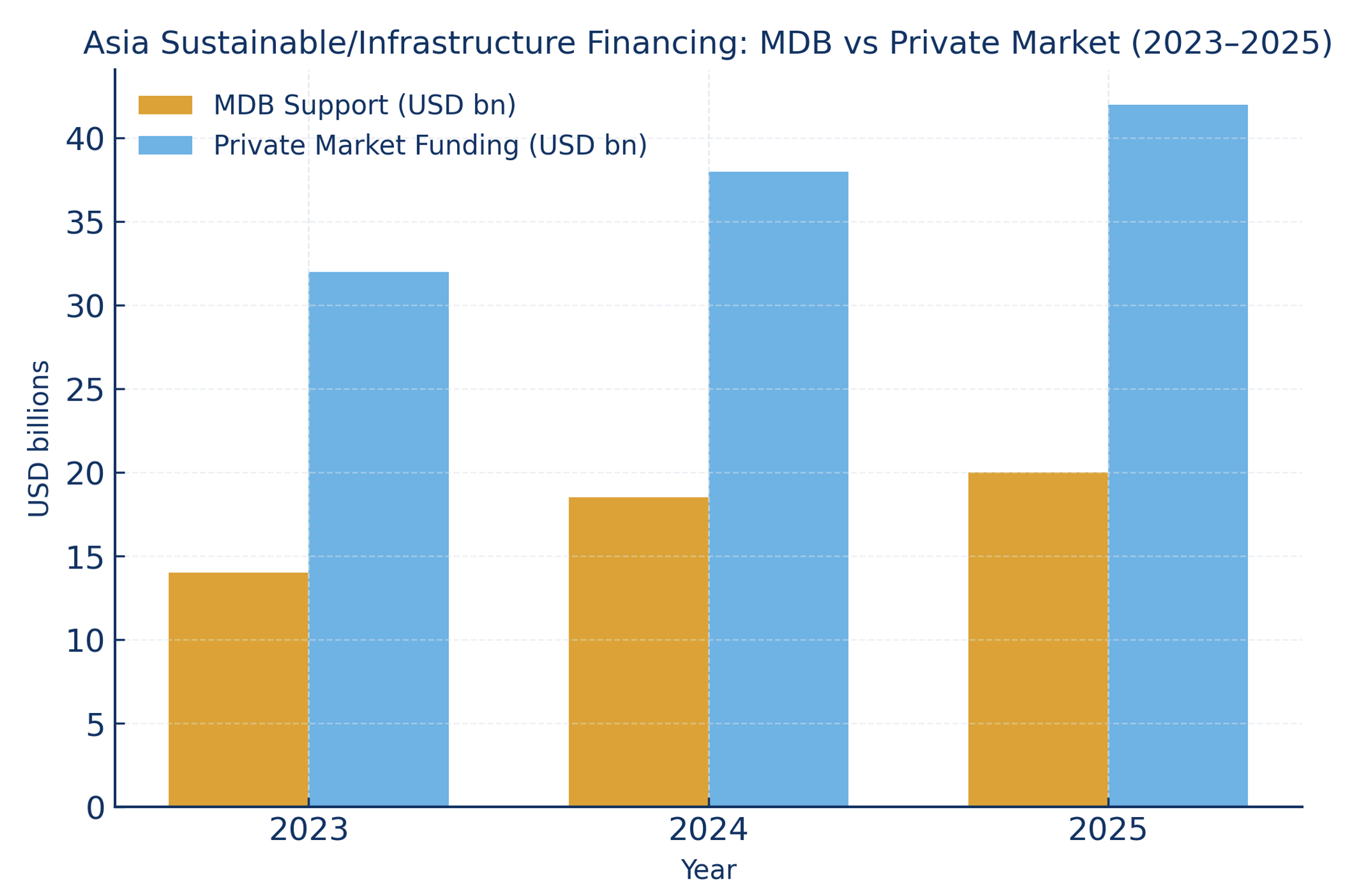

A New Era of Partnerships: ECAs, MDBs, and Commercial Banks

Multilateral development banks (MDBs) and ECAs are increasingly working together to support Asia’s energy transition. Commercial banks like BBVA, with deep experience in ECA financing and sustainable finance, are ideally positioned to bridge public and private capital.

Looking Ahead: Structured Trade Finance as a Catalyst for Resilience

As global trade faces geopolitical realignments and tightening financial conditions, Export and Agency Finance is emerging as a tool of resilience and purpose. In Asia, its evolution from a credit support mechanism to a sustainability enabler marks a profound shift in how banks, governments, and investors collaborate.

By bridging outbound trade with sustainable investment, Export and Agency Finance has become an engine for inclusive, low-carbon growth—helping Asia not only power its own transition but also supply the world with the technologies and materials needed for a greener future.

BBVA: A Strategic Partner in Asia’s Energy and Trade Transformation

At BBVA, our deep expertise in ECA-backed financing and cross-border structured solutions positions us as a trusted partner for clients navigating Asia’s evolving sustainability landscape. Whether supporting decarbonization, renewable infrastructure, or regional supply chains, our team is ready to deliver tailored solutions that align capital with purpose.

To learn more about our Export and Agency Finance offering, contact our BBVA Structured Trade Finance – Export & Agency Finance Asia team.