News | 05 November 2025

Quantitative Edge: a systematic model for obtaining Alpha through Mean Reversion

Turning dislocation into opportunity

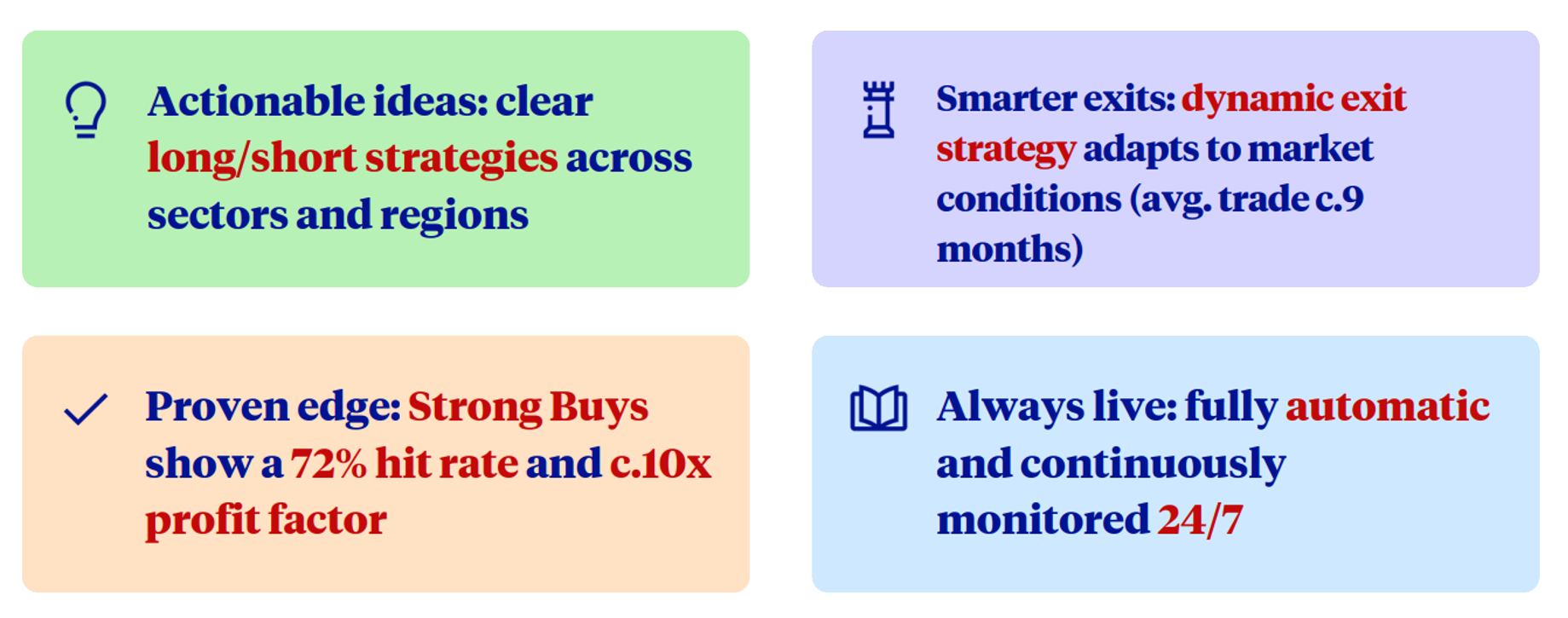

The Quantitative Edge model provides a transparent and disciplined process for turning market dislocations into high-conviction long/short trade ideas. Designed as a proprietary, signal-based mean reversion framework, it systematically identifies and captures alpha opportunities across global equity markets and, most importantly, has consistently delivered alpha profitability for our clients.

Rather than attempting to forecast overall market direction, it focuses on relative value, pinpointing sectors and regions that are undervalued and lagging versus those that appear overstretched. By integrating valuation, momentum, and fundamental signals, the model generates actionable insights for tactical allocation and relative value trading.

A data-driven, multi-layered signal model

At its core, Quantitative Edge measures how cheap or expensive each sector or country is relative to its pair / benchmark (based on forward P/E ratios expressed in standard deviations). This valuation signal is then cross-checked with recent performance trends through price Z-scores, confirming whether market behavior aligns with the underlying fundamentals. Additional filters, including valuation reversion, EPS revisions, and momentum overlays, ensure that signals are robust, consistent, and tradable.

Disciplined exits, consistent results

Trade ideas follow a dynamic exit rule, closing either when valuations revert or after a 12–24 month holding cap. With an average duration of c.9 months, the model balances alpha generation with effective risk control. Since 2015, Quantitative Edge has produced over 400 confirmed trade signals with:

- Hit rates >70%;

- Profit factor c.10x on Strong Buy signals;

Sectors like Communication Services, Consumer Discretionary, and Financials show the highest consistency in mean reversion behavior.

Turning insights into client impact

Beyond the numbers, what truly differentiates Quantitative Edge is how it empowers our clients. Many institutional investors across Latin America highlight that, unlike other banks that simply share a market view, BBVA’s approach provides clear, actionable trade ideas, easy to understand, defend in investment committees, and implement with confidence.

Our teams work hand in hand with clients and sales desks to turn these ideas into real strategies, with a track record that speaks for itself. As Salomon Saba, Cash Equity Institutional Sales at BBVA, explains:

“Quantitative Edge reflects BBVA’s commitment to combining innovation, transparency, and practical insight. It’s a tool that truly helps clients turn analysis into action.”

Always-on signal engine

Fully live and continuously monitored, Quantitative Edge operates as a 24/7 signal engine. The model dynamically updates as new market data arrives, highlighting both confirmed trade ideas and emerging setups to monitor. This ensures that investors are always equipped with timely, data-driven insights grounded in BBVA’s analytical depth.

Built for integration. Whether used independently or as a complement to fundamental analysis, Quantitative Edge enhances portfolio construction by adding a quantitative lens rooted in market behavior and valuation mispricing.

Led by Volodymyr Kmetyk, Equity & ESG Strategy Senior Analyst, under the supervision of Carlos López Ramos, Global Head of Equity and ESG Strategy, this new framework embodies BBVA’s commitment to innovation, transparency and disciplined alpha generation within the Global Markets Strategy team

For further information and disclaimers please visit:

https://custom-eur.cvent.com/9C961EF31A4445E3A6927B2B8F6E8513/files/9c3be62dd683457683096d9177ef60c3.pdf