News | 04 June 2025

The growing role of impact investment funds in emerging markets

Maria Aramoni, DCM XBorder & Iliquids, BBVA Mexico

Impact investing: a global market evolution

Impact investing involves investments made with the dual intention of generating positive, measurable social and environmental impacts alongside financial returns. This growing market seeks to address some of the world’s most pressing challenges, focusing on energy, healthcare, microfinance, sustainable agriculture, infrastructure, and housing sectors.

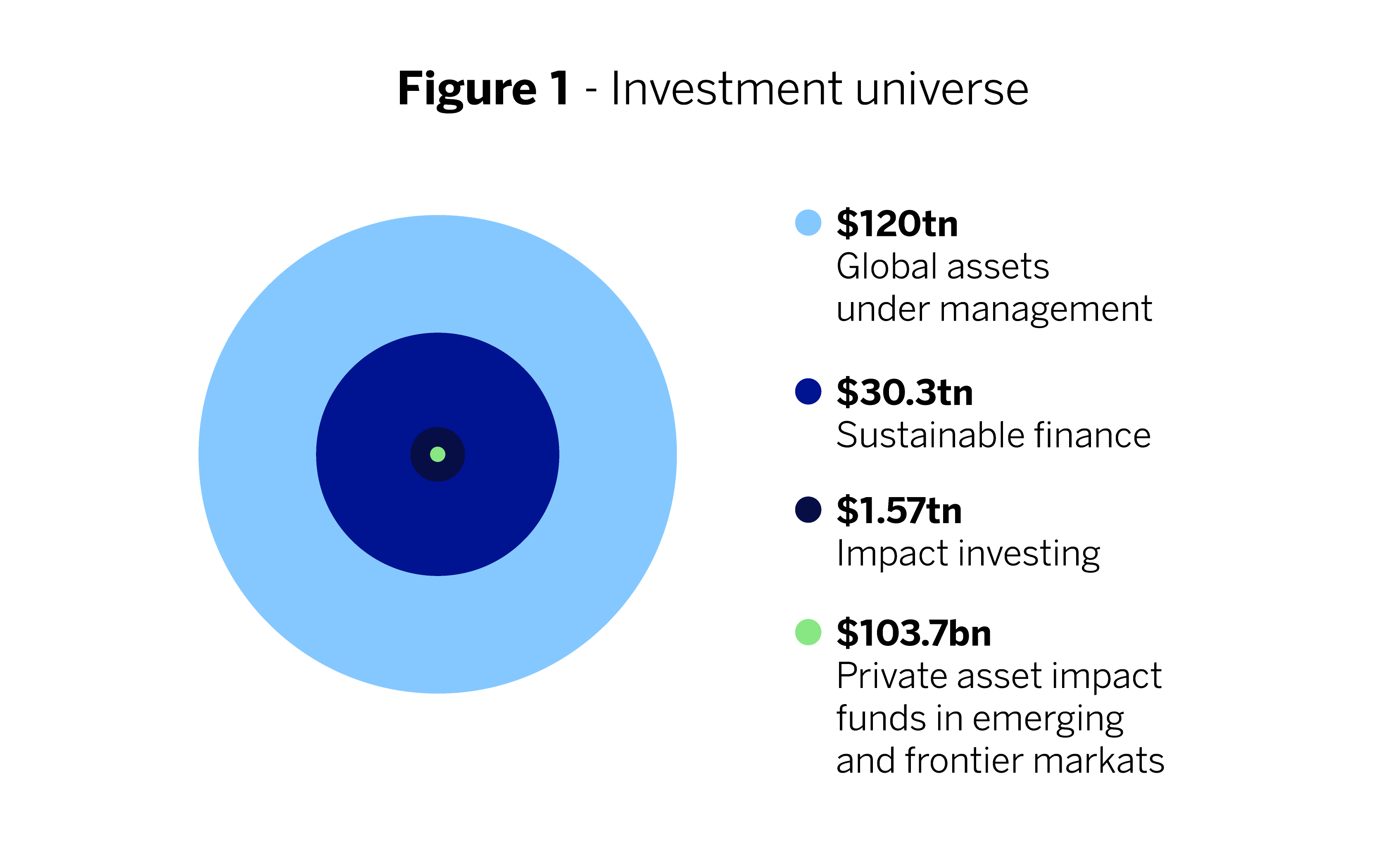

According to the Global Sustainable Investment Alliance’s Global Sustainable Investment Review 2022, USD 30.3 trillion is invested globally in sustainable assets, with non-U.S. markets showing a double-digit growth in sustainable investment assets since 2020. This expansion is reflected across regions where Europe, Australia, New Zealand, and Japan lead in the proportion of sustainable investments.

While sustainable investing encompasses a broad range of strategies, impact investing represents a more targeted approach focused on measurable outcomes. Impact investing funds have emerged as a key pillar in the global shift toward sustainable finance. As of 2024, the GIIN estimates global impact investing AUM at USD 1.571 trillion, reflecting a 21% compound annual growth rate (CAGR) over the past five years. This diverse market includes investment managers, pension funds, development finance institutions (DFIs), philanthropic organisations, banks, and insurance companies. Investment managers nowadays represent 27% of global impact AUM and 59% of market participants.

As the market matures, investment strategies are evolving. In 2024, the GIIN’s State of the Market 2024 report highlighted that assets allocated to impact investment strategies have grown at a CAGR of 14% over the past five years. This steady growth is accompanied by shifts in investment strategies, with equity-like debt and public asset classes emerging as key drivers. Equity-like debt, used in hybrid and mezzanine financing structures, has become the fastest-growing asset class in impact investing. Despite some impact investors not meeting their targets, satisfaction with financial performance remains high, pointing to the importance of robust data-sharing and performance tracking in this sector.

Private impact investing in emerging markets

The Private Asset Impact Fund (PAIF) market, a specialised segment of impact investing focused on private assets in emerging and frontier economies, is currently valued at USD 103.7 billion. According to the Global Sustainable Investment Alliance, this niche holds significant potential to evolve into a central pillar of the broader sustainable investment sector, which is valued at approximately USD 30 trillion. PAIF strategies are designed to finance high-impact projects and companies in developing countries, with Sub-Saharan Africa, Latin America & the Caribbean being the most frequently targeted regions.

Gender lens investing (GLI) in private markets has grown to USD 7.9 billion in assets under management, despite a challenging fundraising environment, with potential market size reaching up to USD 13.6 billion. According to Project Catalyst, a report by 2X Global and Sagana, this growth is driven by an increasingly diverse mix of fund managers and Limited Partners, with gender considerations expanding into traditionally underrepresented sectors like manufacturing and transportation. A USD 6.2 billion investment opportunity exists in funds currently raising capital, offering varied options for investors seeking both impact and returns. Additionally, over 80% of funds now track gender metrics, highlighting a shift toward using this data strategically. Fund managers are also exploring innovative fund structures and incentives, presenting a strong opportunity for transformational gender impact in finance.

Key sectors for impact investments

The key sectors attracting the most impact investments globally include climate and energy, microfinance, food and agriculture, and housing. Among these, climate and energy funds make up 29% of the PAIF market’s AUM, focusing on renewable energy, energy efficiency, and carbon reduction technologies critical for achieving SDG 13 on climate action.

Historically, microfinance funds have been central to impact investing, and they continue to play a significant role, particularly in regions with limited access to financial services. These funds support over 52,000 jobs across emerging economies, with a notable focus on empowering women entrepreneurs, directly addressing SDG 1 (No Poverty).

SME development and agricultural investments also play a critical role, with PAIFs targeting small and medium-sized enterprises in underserved regions. As of 2023, SME development funds in Emerging Markets focused on sectors such as agriculture, services, and trade, contributing to economic growth and aligning with SDG 8 (Decent Work and Economic Growth).

Supporting sustainable growth in emerging markets

Emerging markets often face significant barriers to sustainable growth, including political instability, currency fluctuations, and inadequate infrastructure. Impact investment funds are addressing these challenges by structuring investments to mitigate risks and increase the likelihood of achieving positive financial and social returns.

Many funds in emerging markets rely on technical assistance facilities (TAFs) to build local capacity and ensure that portfolio companies achieve both financial and social objectives. Impact-linked finance is another emerging trend, where financial returns are linked to specific impact milestones, such as job creation, carbon reduction, or water management improvements

Impact investing in emerging markets: aligning capital with sustainable development goals.

The growth of impact investing highlights the increasing alignment of financial markets with the Sustainable Development Goals (SDGs). In emerging markets, impact investment strategies focused on blended finance, sector-specific opportunities, and sustainable growth are driving significant social, environmental, and economic progress. As these regions continue to evolve, the role of impact investors will become even more critical, ensuring that capital not only generates returns but also contributes to achieving global SDGs.