News | 23 September 2025

UK Asset Management 2025 & Beyond: AI, Growth and Sustainability Trends

David Wahi, Head of UK Wealth and Assets Managers, BBVA

Practical priorities for growth in a transformational and AI-accelerated market

Executive summary for UK Asset Managers in 2025

Throughout 2025, Asset Managers have had to navigate volatile markets, tighter margins, and increasingly divergent sustainability regulations. The large-scale adoption of AI and the rise of new growth vectors have highlighted the importance of simplifying, adapting, and delivering measurable outcomes. In this evolving landscape, BBVA strengthens its role as a trusted partner, helping clients anticipate trends and create sustainable value for the years ahead.

The backdrop: busy markets, tighter margins

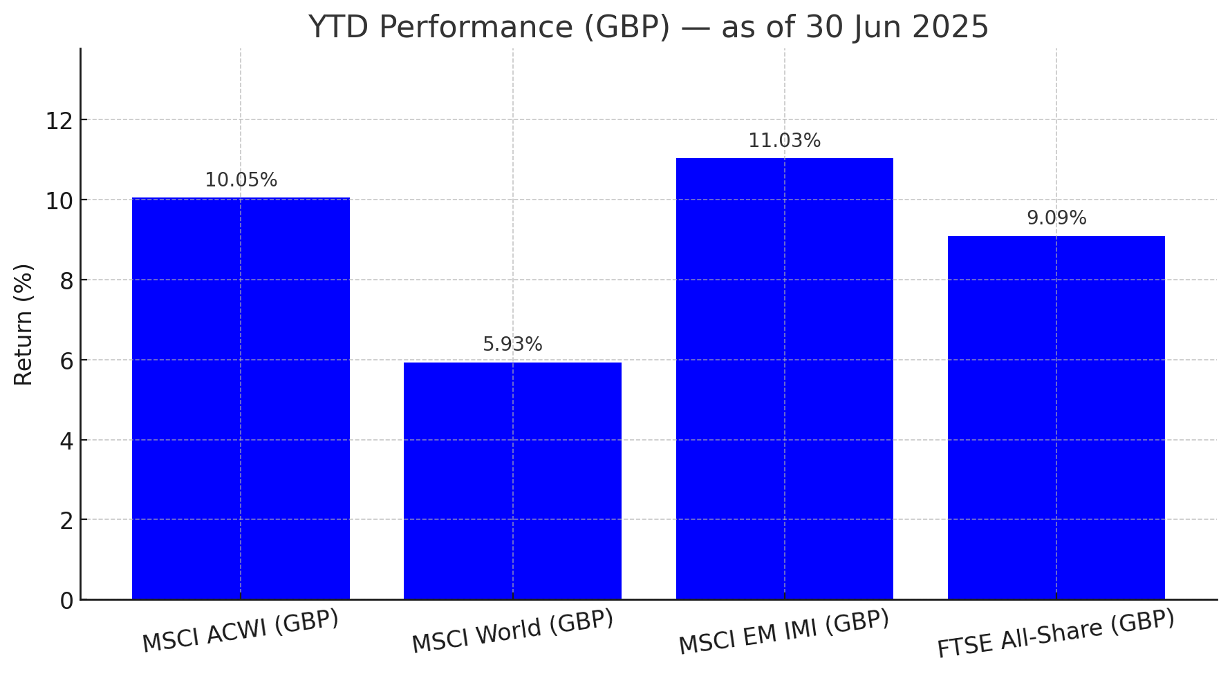

Early‑year buoyancy gave way to high volatility in Q2. Global AUM set a record base in 2024 at £95 trillion of which the UK AM Sector represents £10 trillion, according to the Investment Association; in 2025 YTD, markets have performed strongly with MSCI ACWI +10.05% at the end of H1 2025 (World/DM +5.93%, EM +11.03% and the UK’s FTSE All Share +9.09%). However, structural fees continue to compress and compliance costs rise— further pressuring margins. The UK's AM industry continues to wrestle with stubbornly high cost-to-income ratios, a challenge that CEOs cannot ignore. Culture across firms is being eroded in the face of these challenges further complicating the picture for shareholder returns that have been steady historically. The UK AMs still struggle with lack of size and robust competition from their US counterparts, who have deeper pockets to diversify their businesses faster towards higher margin wealth and private market sectors.

H1 2025 World Indices Performance vs the FTSE All Share Index:

FTSE All share performs strongly versus global indices

Key Forces Reshaping UK Asset Management Strategy

1) AI: from pilot projects to daily productivity

After years of pilots, widely available models incorporating enterprise models are moving AI into day‑to‑day work. The near‑term gains are tangible: Faster answers for PMs, analysts and sales (minutes, not days). Cleaner, on‑time reporting and proposals across regions. Fewer manual steps and errors in routine workflows (KYC, RFP, surveillance). Simple models: data minimisation, role‑based access, approvals, and human oversight. Client acquisition, better understanding of market trends, distribution channels, all benefit from the real-time feedback that can be achieved from AI models. Investing in technology was always a differentiation in the Industry however it couldn’t be more critical now given the pace to adopt and implement these tools to every employee of the firm. 75% of firms are already using AI and another 10% plan to within three years according to the Bank of England. 59% now report productivity gains from AI (up from 32% in 2024) and 51% plan to increase AI investment over the next 12 months. For example, Aviva Investors created a central investment engineering team (build portfolio-management AI tools) and Royal London AM implemented Aladdin + Snowflake as a firm-wide data/IM platform to scale analytics and productivity. Other AMs are investing heavily to differentiate their product and operational capabilities.

“The fastest ROI isn’t in moonshots—it’s in the dozens of routine workflows you run every day.”

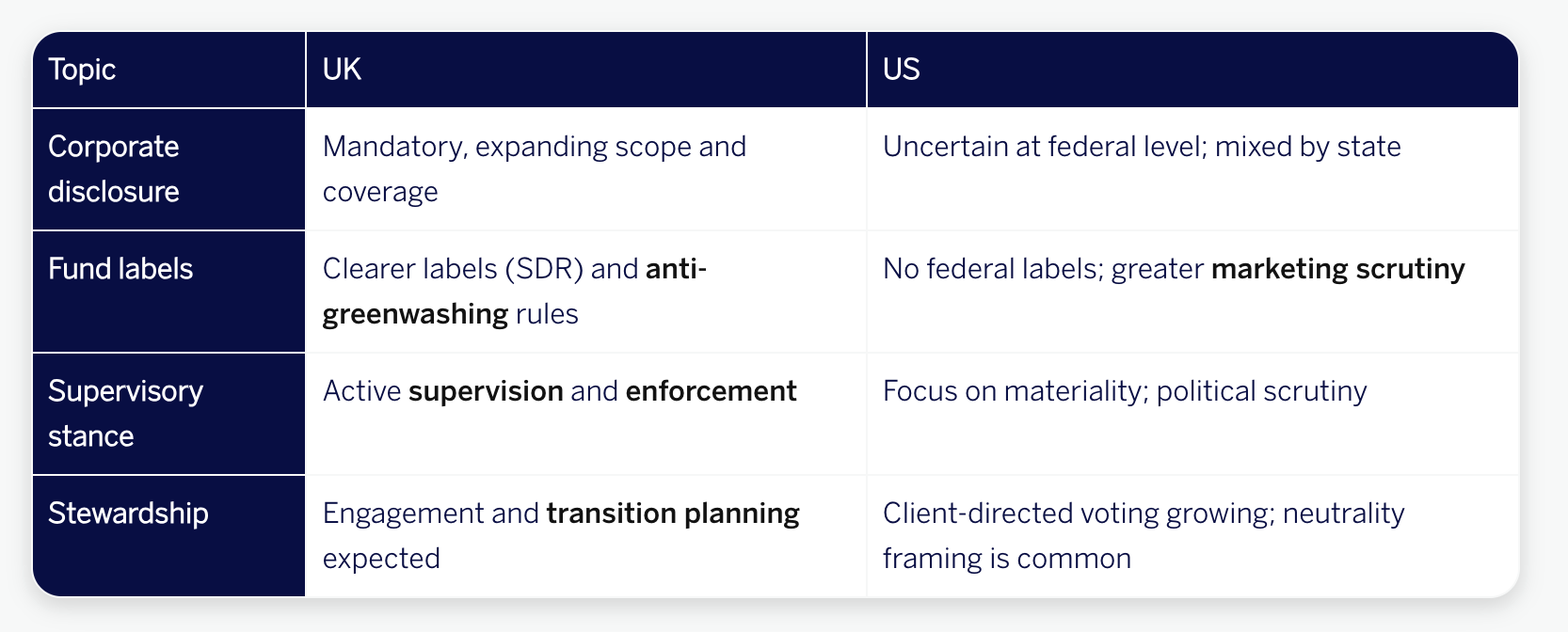

2) Sustainability regulations: Divergent UK vs US Paths

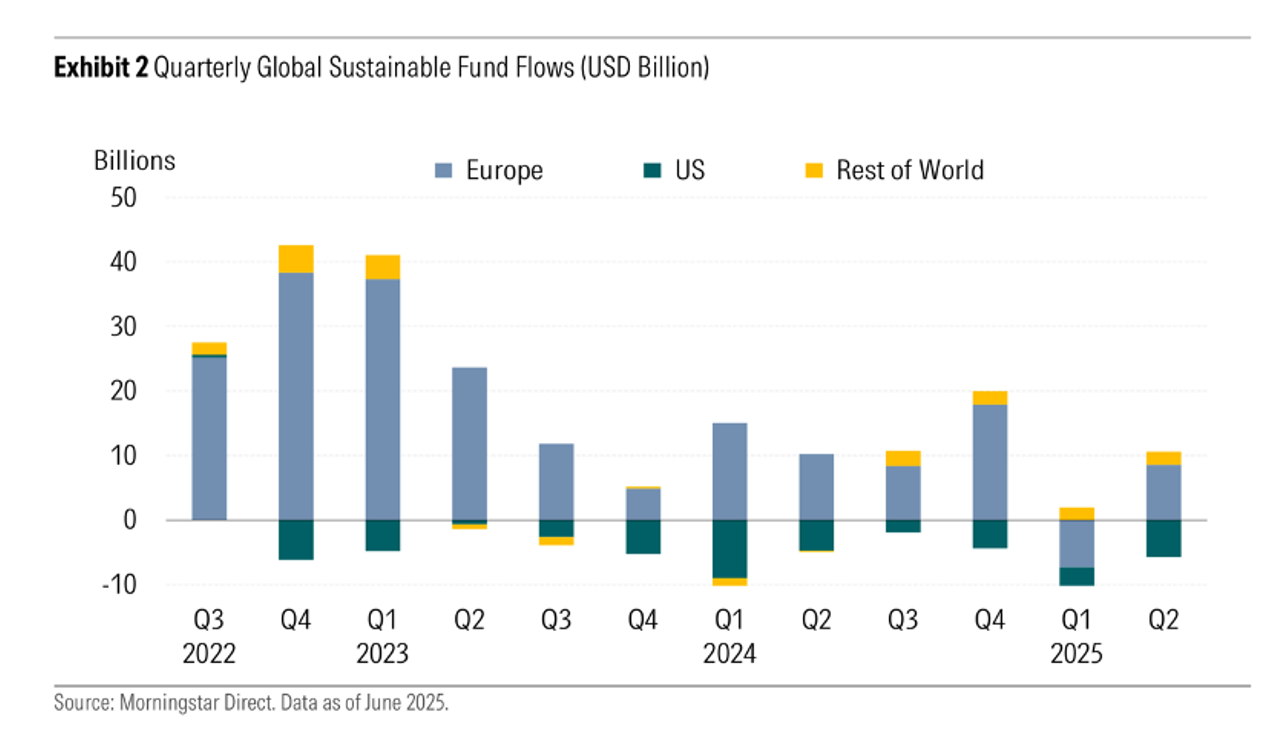

The UK is embedding sustainability into market structure whereas the US remains fragmented at the federal level with a patchwork of state approaches. This shapes disclosures, labels and stewardship—and it influences flows across regions and continents. In Q2 2025, UK Sustainable flows were -£215m, compared with US -£4.5bn and EU at +£65.9bn, further demonstrating that institutional investors still want to maintain a large part of their portfolios in Sustainable strategies and are finding that the UK / EU AMs are still adhering to their local taxonomies.

Q2‑2025 Sustainable Fund Flows by Region Source: Morningstar, Global Sustainable Fund Flows, Q2 2025 report (July 2025).**

Growth Opportunities for UK Asset Managers (2025–2027)

The wrapper revolution: Active ETFs

Active managers are leaning into the practicality, liquidity and accessibility of ETFs. The decade‑long active versus passive debate is converging as active ETFs scale. In H1 2025, US active ETFs drew in £161bn, while UK / EU saw £11.65bn in net flows. UK / European active‑ETF assets were roughly £40bn at the end‑2024 and have accelerated in 2025; industry projections point to around £300bn by 2030. Active ETFs are around 2.12% of LSE-listed ETF AUM which is similar to EU Active ETF penetration. So there is some way to go before Active ETFs gain critical AUM size but the speed and evolution is staggering. Fidelity launched Europe’s first semi-transparent active UCITS ETF in 2025; Columbia Threadneedle plans four active ETFs by late-2025; Aviva Investors is weighing an entry. These examples reinforce the growth trajectory for the Active ETF market in the UK.

Tokenisation: beyond new share classes

Market momentum is visible: tokenised U.S. Treasuries / MMFs total £5.5bn outstanding in 2025 YTD, and BlackRock’s BUIDL had almost £1bn AUM in March 2025. Benefits of tokenised funds include faster settlement, lower costs and less friction across income distributions / reconciliations as the same ledger is shared. In the UK, market‑infrastructure pilots are progressing under the Digital Securities Sandbox (DSS). The DSS is a five-year live-market sandbox intended to inform a new permanent framework for digital securities. Aberdeen AM has tokenised access to its money-market funds with Archax (Hedera/XRPL), achieving same-day payouts and “air-dropped” income for tokenised units.

Private Markets Expansion and Fee Compression

Semi‑liquid structures (e.g., LTAFs in the UK / ELTIFs in Europe) are expanding access to HNW / affluent and UK workplace pension investors. The space remains fragmented, so partnerships or acquisitions can bring niche origination and operational scale together. Fundraising has slowed (about £440bn raised in the 12 months to Jun‑2025, a seven‑year low), while secondaries hit records (roughly £75bn in H1‑2025 across major intermediaries). The Mansion House Compact, the UK’s drive to channel more DC assets into unlisted equity, is lifting demand for semi-liquid vehicles. For managers, this increases the relevance of LTAF structures, DC platform connectivity, and robust liquidity/valuation tooling. L&G, Schroders, Phoenix, M&G, Aviva Investors and a number of other financial institutions have created vehicles to unite on the Mansion House Accord.

Fee compression across the UK AM Industry has been a chronic issue since the exponential rise of ETFs. Wealth channels and Private Markets’ higher margins help offset fee compression—but require robust liquidity management and clear disclosures. Furthermore, consolidation and acquisitions in the UK AM Industry have now shifted from larger scale mergers to bespoke channels across private assets and alternative asset classes. M&G, Jupiter, Man Group, RLAM, all remained active in the consolidation arena over the last 12 months and mainly focused on alternative asset acquisitions.

Transition finance, measured

Institutional commitments are meaningful but not yet at 1.5°C‑consistent pace—creating opportunity for managers with transparent KPIs and engagement roadmaps. On the private‑markets side, UK managers are launching energy‑transition vehicles suitable for DC & Wealth channels — for example Schroders Greencoat’s FCA‑approved energy‑infrastructure LTAF/feeder gives GBP investors access to wind, solar, storage and hydrogen via a semi‑liquid strategy. For asset managers, the edge is to link financing to transparent KPIs and use TPT‑aligned transition‑plan analysis in equity/credit research. The Transition Finance Council (2025) and the Transition Finance Market Review framework aim to scale a UK‑led transition‑finance market in which GBP issuance and GBP‑denominated vehicles play a central role.

Operating & Regulatory challenges in the UK Asset Management Industry

The UK Asset Management industry still faces significant operational and regulatory headwinds. Fragmented rules raise costs and slow speed-to-market, while firms grapple with persistent cost-to-income pressure, AI integration gaps, and private-markets deployment constraints. Broader retail access and heightened oversight (especially on Consumer Duty and fund valuations) further intensify the need for clear priorities, scalable processes, and resilient governance.

How BBVA’s CIB Wealth & Asset Management team can support its clients

At BBVA Corporate & Investment Banking, we see these changes not as headwinds but as opportunities to partner with Asset Managers. With our robust balance sheet, global reach and sustainable finance leadership, we help clients navigate transformation with confidence.

Balance‑sheet support

We support our UK clients with our robust balance sheet to help underwrite and provide meaningful capacity to support fund launches, portfolio growth and financing solutions. Our established expertise across Group, Fund and Private Asset financing further lends to our core principle of helping our clients achieve their strategy.

Real Assets

We are expanding on our global deep underwriting and advisory capabilities for UK AMs from early‑stage development to long‑term debt—including green financing. Our added capabilities include lending to UK Real Estate, Infrastructure and Digital Assets and makes us a partner of choice.

Credit Solutions

Our recently established UK tailored capital solutions across the risk spectrum (e.g., loans / private debt structuring, risk recycling) enhances liquidity, returns and agility for our clients.

Global Markets & Fixed Income

Well established access to primary / secondary fixed income markets, structuring and risk management to manage rate exposure, credit risk and liquidity within regulatory constraints. Our recent capabilities also include financials, MENA and GBP coverage. With a focus on developing our local presence through enhancement of our GBP capabilities, we have strengthened our GBP swaps and FIG DCM coverage through talent and operational capabilities. Our teams based in London provide seamless access to our global platform, creating a unique access point into higher growth geographies.

Sustainability

BBVA is a well established player with ambitious Sustainable Finance targets by channelling €700 billion in sustainable business between 2025 to 2029, more than double the previous target of €300 billion set for the 2018–2025 period, which it reached in December 2024, one year ahead of schedule. Through our Sustainable advisory capabilities we can assist our UK clients to achieve and pursuetheir goals with credibility and support they can expect from a sustainable finance partner like BBVA.