30 January 2024

BBVA CIB reaches revenues of 4.804 billion euros in 2023

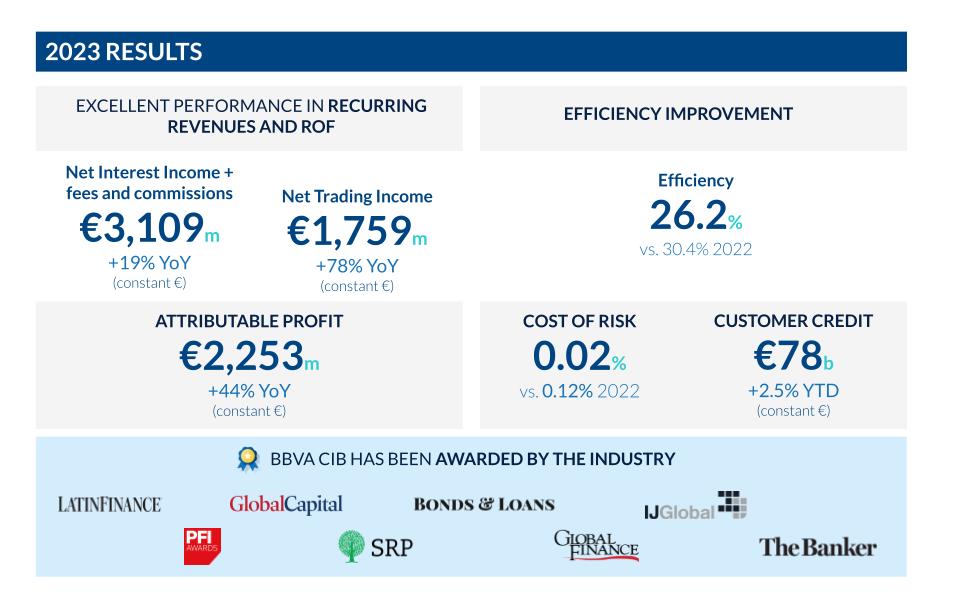

- BBVA CIB achieves accumulated net attributable profit of 2.253 billion euros in the year, a year-on-year growth of 44% (in constant euros and do not reflect the application of hyperinflation accounting).

- The highlight of the fourth quarter is the upturn in activity and growth in revenues, which reached 1.307 billion euros, 45% more than in the same period of 2022.

- Double-digit growth in all business units, especially in Global Markets, mainly in the United States and Emerging Markets, the contribution of Global Transaction Banking in all geographies, and Project Finance in Investment Banking & Finance.

- Improvement in the cost-to-income ratio, which stands at 26.2%, and increase in the profitability of the businesses.

BBVA Corporate & Investment Banking has achieved revenues of 4.804 billion euros in 2023, 35% growth y/y. In turn, BBVA's investment banking division has stood out for recording an attributed net profit of 2.253 billion euros, up by 44% from 2022.

BBVA CIB's results in 2023 confirm the excellent execution of its strategy, leveraged on globality and sustainability. Of particular importance were the contribution of all business units and the effect of their geographical diversification. CIB is thus able to continue providing the Group with solid profit generation and to advance in the creation of opportunities for clients, employees, shareholders and society in general.

BBVA CIB represents, at the end of 2023, 16% of the total gross income of the Group and expects to continue growing based on three key pillars: Geographic diversification and nearshoring opportunities; the business growth vector inherent in sustainability; and the increased relevance of the business with institutional clients.

Business unit performance

Global Markets closed an excellent fourth quarter; the contribution of the FX and Credit businesses are of particular note. FX registered strong growth in emerging markets (Turkey, Mexico and South America), where it is positioned as a leading provider. In turn, Credit harnesses a favorable rate climate to grow in its European and U.S. markets, supported by an excellent primary market and structured credit solutions.

The Global Transaction Banking business closed 2023 with an excellent fourth quarter in terms of revenue generation, with the unit's highest annual figure to date: €1.946 billion. This growth is explained by various factors, including the consolidation of interest rate increases and excellent price management, which underpins the very positive performance of net interest income, both in the quarter and for the year as a whole. This improvement in the net interest income has been supported by significant increases in transactional activity with major clients, as well as by historic volumes in the guarantee business. All of these levers have meant that the fees and commissions heading, which generates recurrence in revenues, has shown double-digit growth both in the quarter and throughout the year.

The activity of Investment Banking & Finance is marked by the macroeconomic high interest rate climate, more restrictive monetary policies and higher funding costs for entities. 2023 saw some contraction in demand for syndicated loans (more pronounced in Europe with falls in volume of -15% and in Spain of -10%), and also lower M&A activity and, therefore, acquisition finance. Even so, BBVA maintains leadership positions in the syndicated loan market, especially in Mexico, with a share of 26% (double the #2 bank in the ranking), and in Spain, at #3, according to Refinitiv.

Similarly, the Project Finance market in 2023 was less active than in 2022. However, BBVA increased its origination activity, with extraordinary performance in some geographies such as the USA. In terms of sectors, sustainability continues to be our main investment theme where a very strong commitment has been made to renewable energy and new clean technologies (Clean Tech). Also, this year, we created a specialized team for this sector.

The activity of Equity Capital Markets in 2023 faced uncertainty due to the complex macroeconomic environment, and substantial reductions in activity observed in most geographies. BBVA has maintained the activity of previous years thanks to the model launched a few years ago (focused on sectors such as Energy, Infra and TMT), and its ability to generate cross-border opportunities in core geographies, which have compensated for lower activity in the middle market.

A geographically diversified business

The contribution by business areas, excluding the Corporate Center, on the accumulated net attributable profit of CIB at the end of December 2023 was as follows: 15% Spain, 29% Mexico, 29% Turkey, 13% South America and 15% in the Rest of Businesses.

Of particular interest is the growth of the cross-border business, which stands for more than 35% of CIB's total revenue and has grown by more than 30% in 2023. This growth benefited from BBVA's geographical diversification and the opportunities derived from nearshoring, which is a particular driver of economic growth in Mexico due to its ability to capture the flow of investment from Asian clients. These figures reflect BBVA CIB's ability to exploit its geographic diversification and capture the business of wholesale and institutional clients outside their home countries.

Finally, the two main pillars of BBVA CIB's value proposition – globality and sustainability – mean that the entity is able to support its global clients in the major investments in energy transition that will be carried out in the emerging economies, especially Latin America and Turkey.

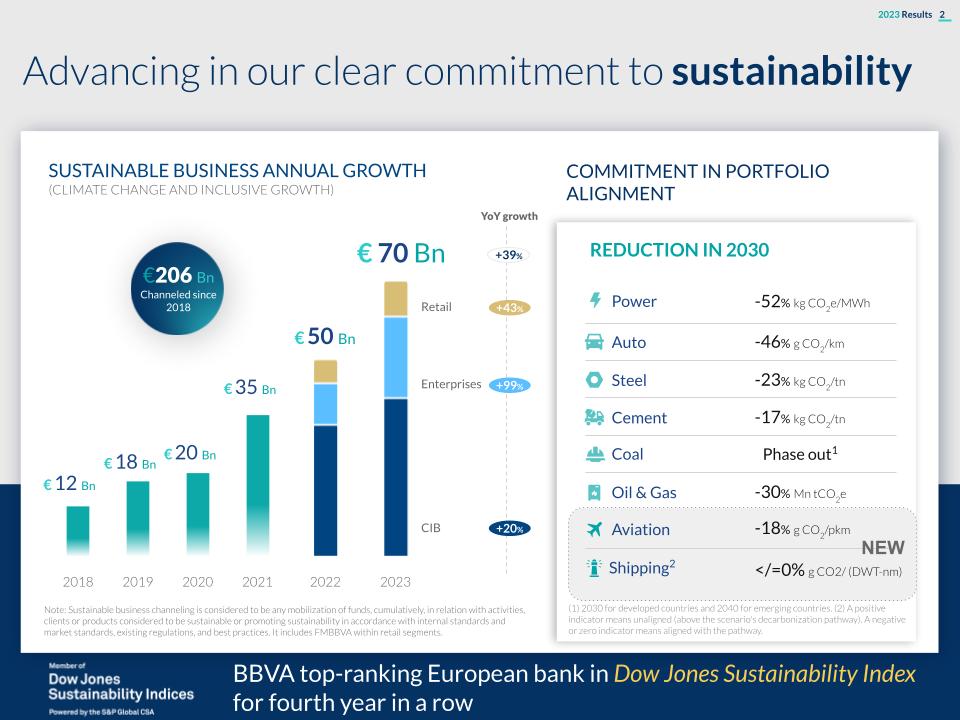

Sustainability as a driver of business

BBVA CIB has channeled more than 40 billion euros in sustainable mobilization throughout the year, of which more than 35 billion are linked to climate change and around 4.5 billion are linked to inclusive growth. This represents an increase of 20% compared to the 33.5 billion euros mobilized in 2022. The bank thus fulfills its goal of proactively assisting its clients in their transformation. For example, the quarter saw operations to promote new technologies for decarbonization (such as green hydrogen, the production of batteries for electric vehicles, renewable energies), as well as support for green and social infrastructures.