BBVA Global Markets Quantitative Investment Strategies & Index Solutions

News | 26 September 2025

Rethink Diversification with BBVA QIS Risk Premia Strategies

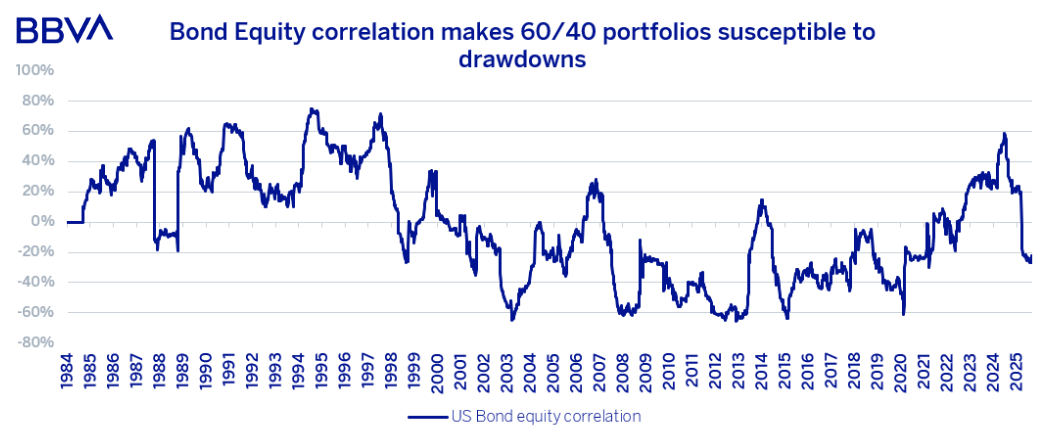

The 60/40 Portfolio: A Model Under Duress

For decades, the 60/40 mix of equities and bonds served as the bedrock for long-term investors. The assumption was simple: bonds would hedge equity drawdowns, and together they would produce a smooth, efficient risk-return profile.

But recent structural shifts have upended that logic:

- Positive stock-bond correlations have emerged since the 2021-2022 inflation shock.

- Inflation, once dormant, has resurfaced and become the dominant macro risk.

- As a result, bonds have lost their defensive appeal and increasingly mimic equity-like behaviour in risk-off regimes.

Simultaneously, the term premium has returned, making long-duration assets more volatile and sensitive to fiscal and policy shifts. In this environment, relying on bonds for diversification may not just be ineffective – it could be dangerous.

Source: Bloomberg and BBVA Global Markets Strategy

Figure 1

Systematic Carry: Returns Without the Crystal Ball

Carry strategies offer a different proposition. Rather than relying on forecasting price movements, they harvest structural risk premia by supplying liquidity and bearing risks others are willing to pay to offload.

Carry is the return from holding an asset, unrelated to directional price appreciation. It comes in many forms:

- Bond coupons and curve roll-down

- Credit spreads

- Option premia from implied-realised volatility gaps

- FX interest rate differentials

- Commodity futures roll yield

What unites them is the principle: by providing liquidity and absorbing unwanted risks (rate, credit, convexity, crash), investors earn consistent yield-based returns over time.

These strategies are not without risk – particularly during periods of market stress. But with careful implementation and dynamic risk controls, they can enhance risk-adjusted returns and offer true portfolio diversification.

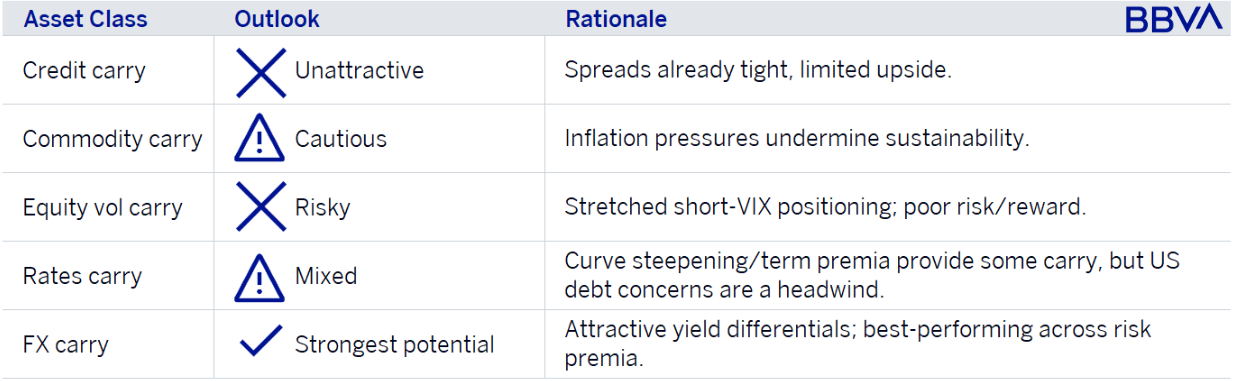

Carry Is Everywhere, But Not All Opportunities Are Equal

Carry premia exist across asset classes, but their attractiveness varies with the macro regime and market pricing.

Credit Carry: Compressed and Unrewarding

In the current environment of excessively loose financial conditions, credit spreads have compressed significantly. Add to that elevated macro uncertainty – including US fiscal risks and geopolitical tensions – and the risk/reward trade-off for credit carry is poor. Entry points are unattractive, and potential drawdowns loom large.

Commodity Carry: Inflation Risk Clouds the View

While commodity carry has had periods of strong performance, today’s inflation-driven volatility and soft demand from China have distorted pricing. Oversupply and uncertain spot dynamics make it hard to rely on this as a core carry engine.

Equity Volatility Carry: Crowding Signals Risk

Short-volatility strategies – especially on the VIX – are heavily crowded. The three-month implied/one-month realised volatility spread is at historically poor risk/reward levels. With macro risks elevated, the potential for sharp drawdowns in vol carry strategies is high.

Rates Carry: Term Premium Reopens the Door, Carefully

The re-steepening of the US yield curve and rising term premia offer selective opportunities in rates carry. But policy rate sensitivity and debt sustainability concerns mean this opportunity comes with elevated risk.

Summary: Cross-asset carry

Source: Bloomberg and BBVA Global Markets Strategy

Figure 2

FX Carry: The Clear Winner in the Current Macro Setup

Among all carry strategies, our assessment is that FX carry stands head and shoulders above the rest in today’s environment.

Here’s why:

- Loose financial conditions and a pro-cyclical growth regime are historically the best conditions for FX carry.

- Wide interest rate differentials, fuelled by divergent central bank policies, provide persistent yield gaps.

- Constraints such as capital controls, cross-currency basis distortions, and hedging demand from corporates and sovereigns all contribute to sustained inefficiencies.

Since April, following the US "liberation day" correction, BBVA’s LatAm FX carry strategy has been the top-performing QIS risk-premia strategy, clearly outpacing all other carry segments.

Mind the Left Tail: Risk Is Real, and Always Present

Despite their structural appeal, carry strategies are not risk-free. Their biggest vulnerability is left-tail risk – that is, large drawdowns when market stress triggers demand for the very insurance these strategies implicitly sell.

In crisis regimes:

- Correlations rise across risk assets.

- Margin and funding constraints tighten.

- Liquidity vanishes.

- Forced deleveraging leads to pro-cyclical selling.

- Crowding worsens exit conditions.

Historically, every 20%+ equity drawdown has been accompanied by losses in carry portfolios. This is not a bug – it’s a feature of the strategy.

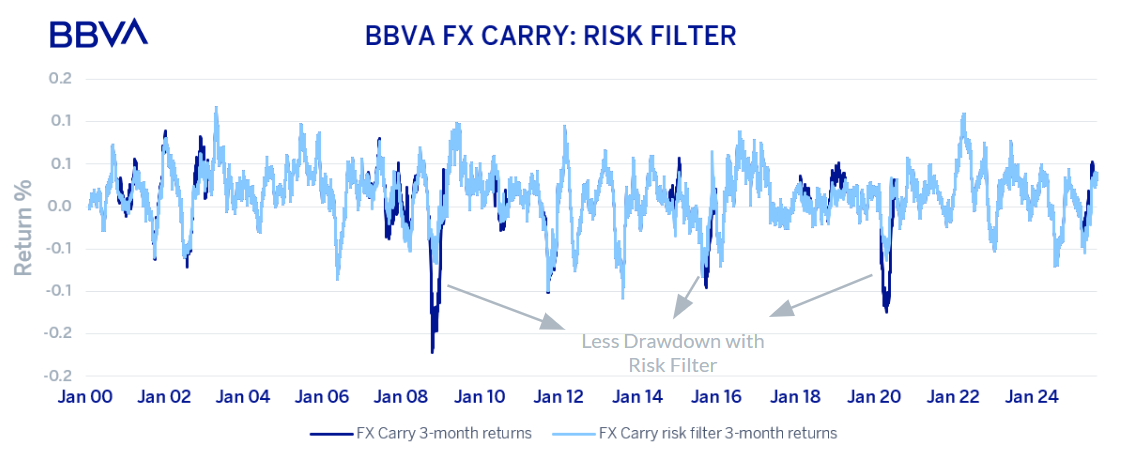

VIX-Based Risk Filters: Protecting the Carry Engine

To mitigate this structural vulnerability, BBVA incorporates a VIX-based risk filter into its carry strategy framework.

This dynamic overlay reduces exposure during volatility spikes, protecting against systemic shocks.

What does it achieve?

- Higher Sharpe ratios than traditional equity exposure.

- Drawdown protection during key stress periods (e.g., 2008, 2020).

- Excess returns of c.10% compared to passive carry allocation during crises.

Encourages higher risk allocation to carry by lowering the downside risk.

Source: Bloomberg and BBVA Global Markets Strategy

Figure 3

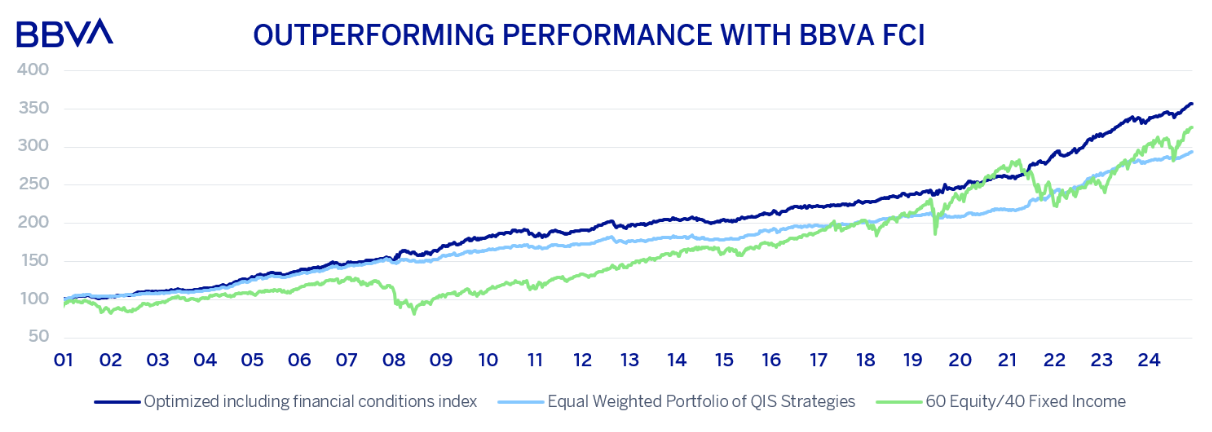

The Financial Conditions Index: Allocating Smart in a Macro World

If carry is the engine, then the Financial Conditions Index (FCI) is the GPS.

Post-GFC, central banks have expanded their toolkit beyond policy rates – using balance sheets, forward guidance and liquidity tools to influence financial conditions more broadly. The FCI now captures the full transmission mechanism from policy to markets.

Why is this crucial?

- FCI leads inflation and the macro cycle by 3-6 months.

- Loose conditions precede reflation, growth and strong risk-asset performance.

- Tight conditions warn of slowdown, risk aversion and equity underperformance.

FCI as an Allocation Tool

When used dynamically to allocate across QIS risk premia strategies:

- Sharpe ratios improve dramatically – from 0.6x (60/40) to 1.5x+.

- Volatility falls by two-thirds, and maximum drawdowns drop by 85%.

- Dynamic FCI-based allocation outperforms both equities and static QIS portfolios.

In other words, incorporating macro signals such as FCI isn’t just academically appealing –it’s practically transformative for risk-adjusted returns.

Source: Bloomberg and BBVA Global Markets Strategy

Figure 4

Conclusion: Carry, Calibrated for a New Era

In today’s fractured macro landscape, investors need more than passive allocation – they need tools that adapt to evolving risks and regimes.

- Carry strategies offer structural return, uncorrelated to traditional beta.

- FX carry is the standout opportunity in the current regime.

- Risk filters such as the VIX provide essential protection against systemic shocks.

- FCI-driven allocation models bring it all together – ensuring the right strategies are deployed at the right time.

So yes – while the old 60/40 model strains under modern pressures, a well-constructed, risk-aware, dynamically allocated carry portfolio is ready for prime time.

Keep calm. Carry on. But do it smartly.

Ankit Gheedia, CFA

Head of QIS research, Global Markets Strategy