Thematic & Smart Beta Investing

Indices capturing alpha via long-only exposure to the most relevant megatrends:

We bring responsible and transparent investment opportunities to everyone through investable indices

Thanks to our best-in-class analysis capabilities, we deep dive into the most relevant market trends and factors, assessing them from both quantitative and fundamental perspectives to identify their value drivers, and integrating them at the core of the methodology of our indices.

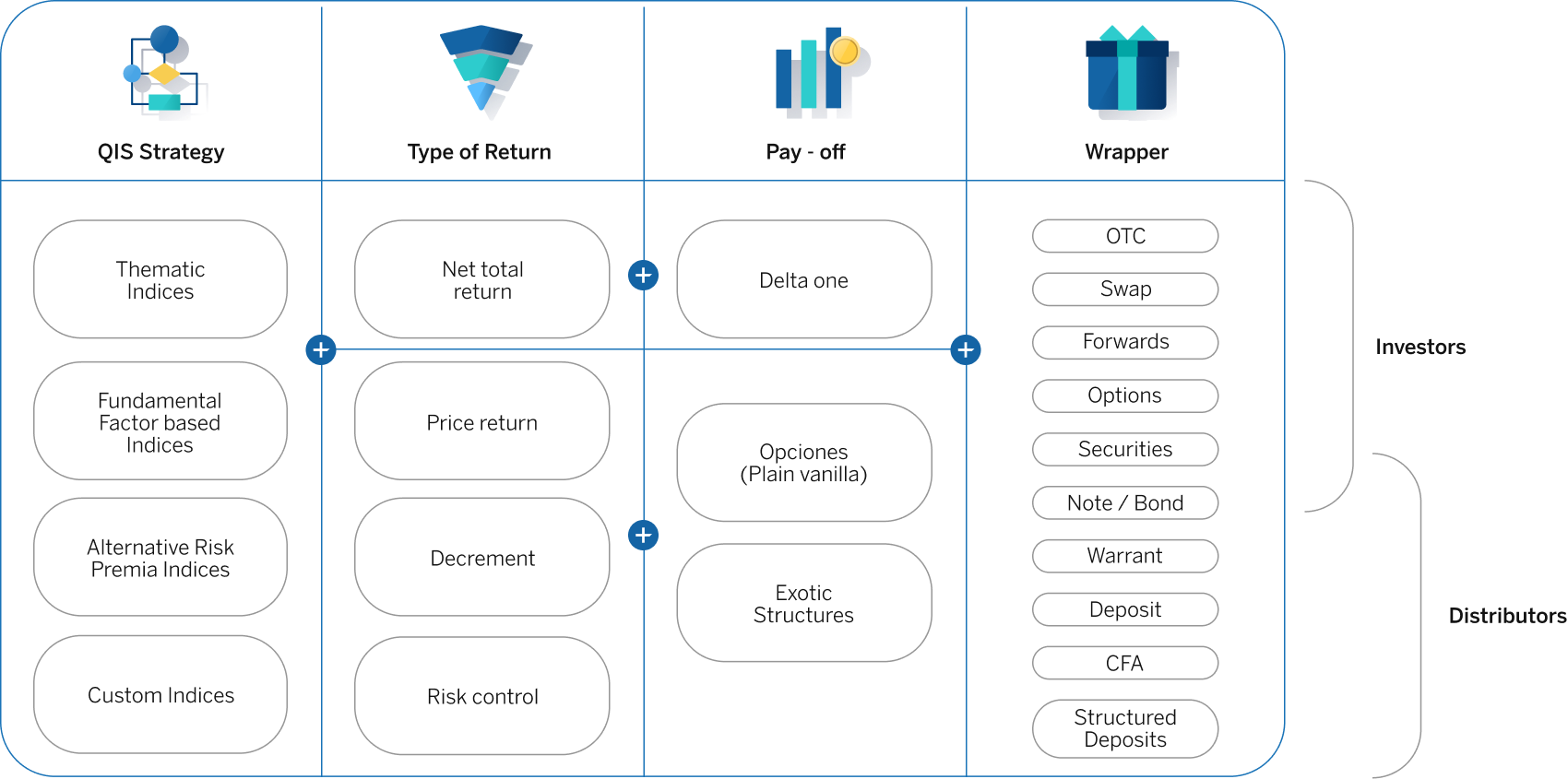

BBVA QIS indices can be classified into the following categories, based on the underlying investment idea and investment purpose:

Thematic & Smart Beta Investing

Indices capturing alpha via long-only exposure to the most relevant megatrends:

Additionally, BBVA QIS offers Tailor-made indices, developed jointly with clients to meet their specific investment requirements. These could be a combination of the existing indices or built completely from scratch.

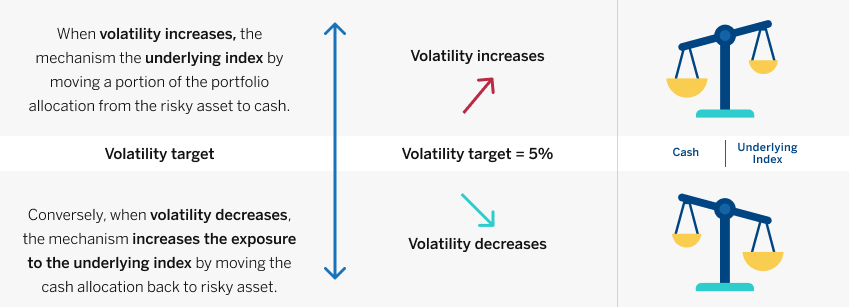

BBVA QIS has designed Risk Control and Decrement mechanisms that keeps volatility and dividend parameters at predetermined levels. This way, investors can protect themselves against high volatile market conditions and increase their participation in growth structured products.

Risk control indices are designed to keep volatility and dividend parameters at predetermined levels. They adjust dynamically their exposure to the underlying index (risky asset) depending on the market realised volatility level.